How to Open a Wells Fargo Savings Account Online

Opening a savings account at Wells Fargo is a straightforward process that can be completed online within minutes. Whether you’re looking to start saving for the future or simply want a safe place to keep your money, Wells Fargo offers multiple savings account options that you can apply for directly from their website. Wells Fargo Open Savings Account can be opened easily.

Also read:- Wells Fargo Savings Account Interest Rate

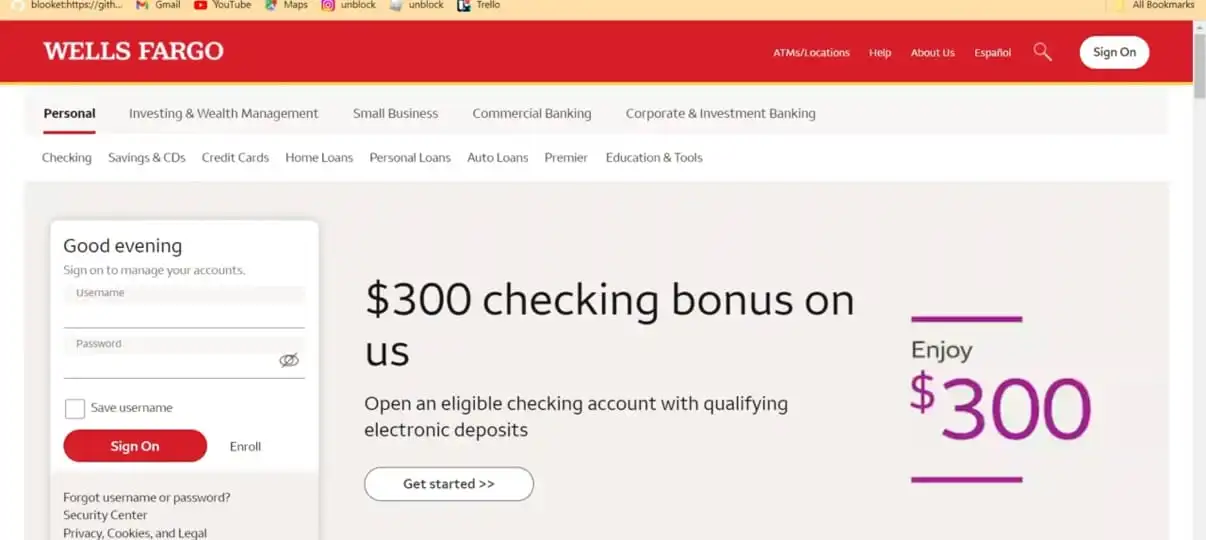

Step 1: Visit the Wells Fargo Website

Start by opening your browser on your computer or mobile device. Go to the official Wells Fargo website: wellsfargo.com.

Once you’re on the homepage, tap on the menu icon in the top-right corner and choose Savings under the “Banking and Credit Cards” section.

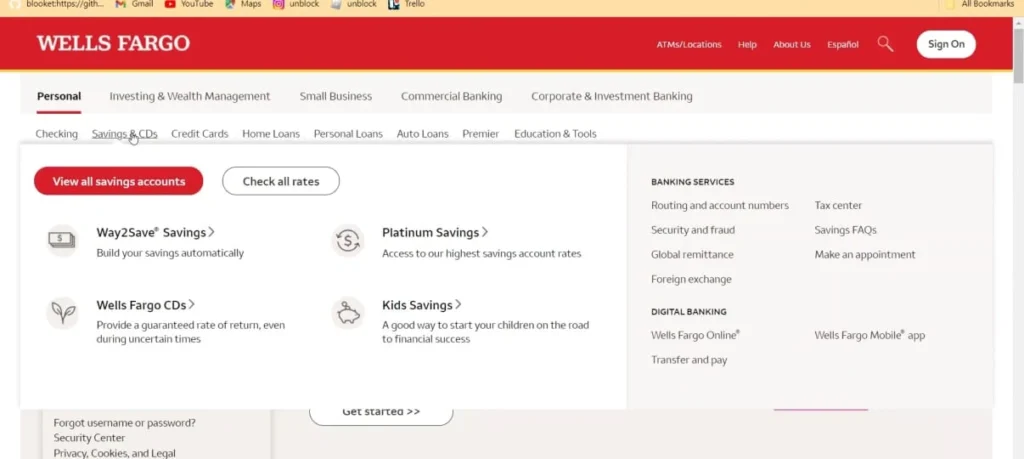

Step 2: Choose Your Savings Account Type

Wells Fargo provides several savings account options, including:

- Way2Save® Savings – great for beginners who want to build savings automatically.

- Platinum Savings – ideal if you’re looking for a higher interest rate.

- Kids Savings – designed for minors.

- Certificates of Deposit (CDs) – fixed-term savings with locked-in rates.

For this guide, let’s select the Platinum Savings option. You can always compare the accounts and decide which one works best for your financial goals.

Step 3: Click on “Open Now”

After selecting your preferred account, click the Open Now button. This will take you to the application page where you can start filling out your personal information.

Step 4: Prepare the Required Information

Before applying, make sure you have the following documents and details ready:

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- A valid government-issued ID (Driver’s license, State ID, or Matricula card)

- Your home address and contact details

- Employment/occupation information

Step 5: Complete the Application Form

You’ll be asked to provide the following details:

- Full name (first, middle, last)

- Date of birth and citizenship status

- Social Security Number or Taxpayer ID

- ID type, number, issuing state, and expiration date

- Email address and phone number

- Residential address, city, state, and ZIP code

- Employment information and tax certification

Once all details are entered, check the box to agree to Wells Fargo’s terms and conditions, then click Continue.

Step 6: Verify Your Identity and Submit

On the next page, you’ll need to verify your identity by uploading your ID. After successful verification, Wells Fargo will confirm your account opening. You may also need to make an initial deposit to activate the account.

Interest Rates and Fees Explained

When opening a savings account at Wells Fargo, it’s important to understand how the interest rates and fees work:

💰 Interest Rates

- Way2Save® Savings – Typically offers a lower interest rate, best for customers who want a simple savings account with automatic transfers.

- Platinum Savings – Offers a tiered interest rate. The more you save, the higher the interest you can earn. This account is ideal for people maintaining larger balances.

- CDs (Certificates of Deposit) – Offer fixed interest rates for a set period (e.g., 6 months, 12 months). These rates are usually higher than standard savings but your money is locked until maturity.

⚠️ Interest rates may vary depending on your location and market conditions, so it’s best to check the latest rates on Wells Fargo’s official savings page.

🏦 Fees

- Monthly Service Fees:

- Way2Save® Savings: Around $5/month (waived if you meet requirements, such as maintaining a $300 balance or setting up automatic transfers).

- Platinum Savings: Around $12/month (waived if you maintain a $3,500 balance).

- CDs: No monthly service fees, but early withdrawal penalties apply if you take out your money before maturity.

Why This Matters

Understanding interest rates helps you decide which account is the most profitable for your financial goals. Meanwhile, knowing the fees ensures you don’t end up paying unnecessary charges.

Final Thoughts

Opening a Wells Fargo savings account online is quick and secure. Just gather your documents, choose the account type that best matches your goals, and complete the online form.

By comparing interest rates and fees in advance, you can select the account that offers you the most benefits while avoiding unnecessary charges.

👉 If you’re ready, visit wellsfargo.com and open your account today.